Table of Contents

Introduction

(GST) has revolutionized tax payment in India since its enactment on July 1, 2017. The primary objective behind this move was to simplify taxation procedures by merging numerous taxes that caused confusion before GST’s implementation into one comprehensive system. This measure aims at promoting clarity, fairness for every taxpayer resulting in well-informed financial transactions across all sectors- from buying groceries to investing in a business enterprise. By easing compliance costs and fostering an efficient process flow throughout industries nationwide, the benefits are far-reaching towards optimizing economic growth while making everyday purchases more manageable. Therefore, beyond being just another modification affecting only taxpayers’ bills: GST is a significant step towards creating simplicity and improving living standards overall within our society as citizens strive toward greater prosperity together with ease-of-accessibility around finances when it counts most!

GST

- Introduction to GST:

- The definition of GST is Goods and Services Tax.

- The implementation date in India (July 1, 2017) should be mentioned.

- Purpose of GST:

- The objective of GST is to streamline the taxation system by substituting several indirect taxes.

- Emphasize its contribution to establishing a cohesive marketplace throughout the nation.

- GST Structure:

- the GST framework entails three components – Central GST (CGST), State GST (SGST) and Integrated GST (IGST) which apply to transactions between states.

- Tax Slabs:

- Elaborate on the distinct tax brackets, namely 5%, 12%, 18% and 28%. Also, specify which commodities belong to each individual bracket.

- Input Tax Credit:

- Input Tax Credit, which permits businesses to obtain credit for taxes paid on inputs, will be examined in this discussion.

- Composition Scheme:

- Small businesses can benefit from the Composition Scheme, which enables them to remit a fixed percentage of their overall revenue as taxes..

- GST Registration:

- Describe the requirements for getting registered under GST and explain the steps involved in this procedure.

- GST Returns:

- Explain the regular filing process of GSTR-1, GSTR-3B and annual return GSTR-9 in a brief manner.

- E-way Bill:

- Let’s elaborate on the E-way Bill mechanism that enables goods to move effortlessly.

- Impact on Businesses:

- Emphasize the means by which GST has streamlined business compliance and curtailed tax cascading.

- Challenges and Concerns:

- Recognize the difficulties that businesses encounter during their transition period and any persistent apprehensions.

goods and services tax act

Goods and Services Tax (GST) Act:

- Introduction:

- On July 1, 2017, the GST Act was implemented by the Indian Parliament as a replacement for several indirect taxes.

- The aim of introducing it was to establish a tax system that is uniform and uncomplicated throughout the entire country.

- Tax Structure:

- The GST tax system has a variety of levels with four primary taxation categories, namely 5%, 12%, 18% and 28%.

- Certain essential items and healthcare services may qualify for exemption or reduced taxation.

- Dual Taxation System:

- The GST Act enforces a two-fold tax regime, wherein the central government charges Central Goods and Services Tax (CGST), while state governments impose State Goods and Services Tax (SGST).

- Integrated GST (IGST):

- To facilitate smooth trade among the states, the introduction of Integrated GST (IGST) within the provisions of GST Act is implemented for inter-state transactions.

- The central government is responsible for imposing and receiving IGST.

- Registration and Thresholds:

- Registration under GST is mandatory for businesses that exceed a certain annual turnover limit.

- The registration threshold limits are different for various states and union territories.

- Input Tax Credit (ITC):

- Input Tax Credit (ITC) can be claimed by businesses under the GST Act, for taxes paid on inputs utilized in production or service delivery procedures.

- The utilization of ITC prevents the spread of taxes, thereby lowering the general tax load.

- Returns and Compliance:

- It is compulsory for registered businesses to file GST returns on a regular basis.

- Specific deadlines must be met for filing various types of returns, such as GSTR-1 pertaining to external supplies and monthly summaries represented by GSTR-3B.

- E-way Bill System:

- The implementation of the E-way Bill system has been introduced by The Act to regulate the transportation of goods beyond state borders, based on a predetermined value threshold.

- It is mandatory to have E-way Bills for the transportation of designated goods.

- Composition Scheme:

- The Composition Scheme is available for small businesses that have an annual turnover under a set limit.

- Under this program, enterprises have simplified compliance obligations and pay tax at a set rate.

- Anti-profiteering Measures:

- There are provisions in the GST Act that require businesses to transfer the advantages of lowered tax rates to their customers.

- The task of overseeing and guaranteeing equitable pricing falls under the purview of an anti-profiteering authority.

- Amendments and Updates:

- Official notifications are used to communicate amendments and updates made to the GST Act, which may include changes in tax rates, thresholds, and compliance requirements.

- Objective and Impact:

- To streamline the tax system, curb tax avoidance and establish a uniform marketplace is the core aim of The GST Act.

- Improving compliance and promoting a transparent and efficient tax environment, it greatly affects businesses.

central goods and services tax act 2017

Central Goods and Services Tax (CGST) Act, 2017:

- Implementation:

- The Goods and Services Tax (GST) regime, introduced in India, includes a fundamental component known as the CGST Act.

- The Indian Parliament put it into effect on July 1, 2017.

- Tax Authority Headquarters:

- The authority to impose and gather taxes named Central Goods and Services Tax (CGST) is vested with the central government as per CGST Act.

- CGST transactions are administered and regulated by the central tax authority.

- Tax Structure:

- Taxes are imposed on the provision of commodities and amenities within a state or union territory as per the CGST Act.

- Various tax rates are instituted and enterprises that enroll under CGST have the ability to assert Input Tax Credit (ITC) for input taxes paid.

- Input Tax Credit (ITC):

- Businesses can claim Input Tax Credit (ITC) on taxes paid for the inputs utilized in goods and services production or delivery, as authorized by The Act.

- By enabling businesses to offset taxes paid on inputs against output tax liability, ITC reduces the tax burden imposed on them.

- GST Registration:

- CGST registration is mandatory for businesses crossing the designated revenue threshold.

- By registering, businesses can obtain CGST from their clients and avail Input Tax Credit.

- Returns and Compliance:

- Regular returns, such as GSTR-1 for outward supplies and monthly summary GSTR-3B, are mandatory filing requirements for registered businesses.

- To evade penalties and ensure frictionless business operations, it is necessary to comply with CGST regulations.

- Threshold Limits:

- Mandatory registration under CGST is determined by specific turnover thresholds as set by the CGST Act.

- CGST regulations mandate businesses that surpass these thresholds to register and adhere.

- Audit and Assessment:

- To ensure adherence to CGST provisions, audits and assessments can be carried out by the central tax authority.

- Tax filings of businesses may need to be verified through close examination.

- Anti-profiteering Measures:

- The CGST Act, akin to the GST Act, has measures in place that prohibit businesses from unfairly profiting due to decreased tax rates.

- It guarantees that the advantages of tax cuts are transferred from businesses to customers.

- Penalties and Offenses:

- Penalties for non-compliance, such as late return filing and tax evasion, are specified in the CGST Act.

- To avoid legal ramifications, businesses must comply with the provisions.

- Amendments and Updates:

- Modifications and revisions are made to the CGST Act in order to tackle evolving business dynamics and regulatory prerequisites.

- Official notifications, issued by the central government, serve as a means of communication for changes.

New GST registration

For new GST registration in India, follow these steps:

- Visit the GST Portal: visit the GST portal’s official website (www.gst.gov.in) to begin the registration process.

- Click on “New Registration”: Under the “Services” tab on the GST portal’s homepage, select “New Registration.”

- Enter Basic Details:Please provide your legal name, PAN (Permanent Account Number), email address and mobile number. The verification process will involve receiving an OTP (One-Time Password) on both the provided mobile number and email for validation purposes.

- Enter OTP and Verification: To verify your details and continue with the registration process, input the OTP you received on both your mobile number and email.

- Fill Application Form: Complete the GST registration form by filling in details such as business name, address, nature of business and information on promoters/partners.

- Upload Documents: To facilitate GST registration, please upload the required documents which include PAN card, proof of business address, bank account details and authorized signatory information.

- Submit Application: To submit your application, please ensure that you have reviewed all the information provided and attached the necessary documents to the application form.

- ARN Generation: Upon completing the submission process, a confirmation email and SMS containing an Application Reference Number (ARN) will be sent to you.

- Processing by Tax Officer: The respective tax officer reviews and approves your application forwarded by the GST portal.

- Verification by Tax Officer: The tax officer may conduct further verification or seek additional information if required. Additional information may be required by the tax officer, who has the authority to conduct further verification.

- GSTIN Allotment: After verifying and approving, the tax officer will provide you with your Goods and Services Tax Identification Number (GSTIN).

- Login Credentials: To gain access to the GST portal for filing returns, making payments, and other activities related to GST, utilize the login credentials provided along with your unique GSTIN.

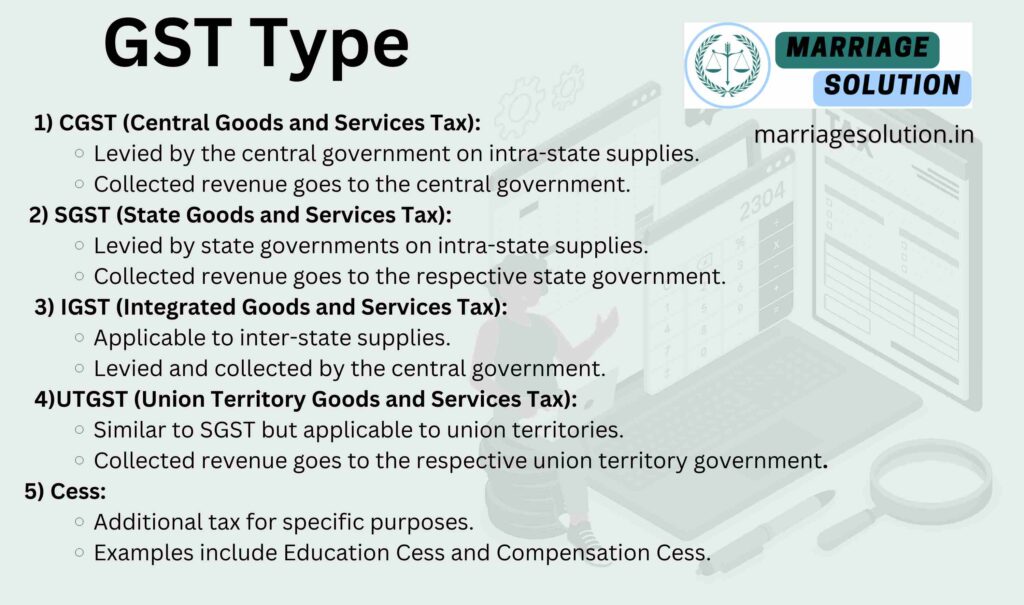

GST Type

India’s GST (Goods and Services Tax) is categorized into various types, taking into account the nature of goods/services involved in the transactions.

- Central Goods and Services Tax (CGST):

- The central government imposes CGST on the supply of goods and services within a state as part of GST.

- The central government receives the revenue generated by CGST.

- State Goods and Services Tax (SGST):

- State governments impose SGST on supplies of goods and services within the state as a part of GST.

- The SGST revenue is directed to the corresponding state government.

- Integrated Goods and Services Tax (IGST):

- The IGST represents the GST element that pertains to the provision of goods and services between different states.

- The central government is responsible for imposing and gathering it.

- In inter-state transactions, the Central Sales Tax (CST) has been replaced by IGST

- Union Territory Goods and Services Tax (UTGST):

- The application of UTGST is akin to SGST, with the only difference being that it pertains exclusively to India’s union territories.

- The union territory governments receive the revenue collected via UTGST.

- Cess:

- A special tax called cess is imposed on particular goods and services to support specific projects or tackle distinct issues.

- The Education Cess and Compensation Cess are among the examples.

GST Log in

A Simple Guide to GST Login

Introduction: Accessing the GST (Goods and Services Tax) portal marks a beginning to effortless management of tax procedures. Irrespective of being a business proprietor or taxpayer, this guide elaborates on simple steps that can be followed for logging into your GST account with ease.

Step 1:Begin your GST-related activities by accessing the central hub, which is the official GST portal at www.gst.gov.in. Make sure to visit Step 1 in order to get started.

Step 2:Finding the “Login” Button: When you arrive at the homepage, locate the button labeled “Login.” This is typically found in the upper right-hand corner of your screen. Click this button to access the login page.

Step 3: Provide Your Credentials When on the login page, you will be asked to input your Username and Password. Before proceeding, ensure that you have registered for these credentials and they are readily available.

Step 4:Complete the Captcha Verification To ensure additional security, a captcha must be solved. Enter the characters shown in the image to confirm your human identity.

Step 5: Clicking on the “Login” button. You will be required to provide your login details and solve a captcha before gaining access to your GST account.

Step 6: Discover Your GST Dashboard Great job! You have logged in successfully. Take a look at your GST dashboard and explore all the features, which allow you to file returns, settle payments and update your profile information.

To ensure account safety, it’s crucial to maintain confidentiality of login credentials. Avoid sharing your Username and Password with anyone under any circumstances as a security measure.

What is difference between CGST,SGST,IGST.

| Parameter | CGST | SGST | IGST |

|---|---|---|---|

| Full Form | Central Goods and Services Tax | State Goods and Services Tax | Integrated Goods and Services Tax |

| Applicability | Intra-state transactions within a state | Intra-state transactions within a state | Inter-state transactions between two states |

| Jurisdiction | Levied and collected by the Central Government | Levied and collected by the State Government | Levied by the Central Government and collected by the Central Government but distributed to the destination state |

| Utilization of Tax | Collected by the Central Government and utilized by both Central and State Governments | Collected by the State Government and utilized by the respective State Government | Collected by the Central Government and distributed to the destination state, where the final tax liability accrues |

| Rate | Rate fixed by the Central Government | Rate fixed by the State Government | Rate determined by the GST Council |

| Revenue Allocation | The revenue from CGST goes to the Central Government | The revenue from SGST goes to the State Government | The revenue from IGST is distributed between the Central and State Governments based on the destination principle |

| Documentation and Compliance | Separate CGST return needs to be filed along with other GST returns | Separate SGST return needs to be filed along with other GST returns | IGST is collected and paid during inter-state transactions, and input tax credit is available for the same |

If you require assistance with court or any other Cases.

court or any other marriage-related issues, our Home – MarriageSolution.in: Your Trusted Partner in Family Legal Matters. Law Services, IPC Section blog, Expert Advice, court cases lawyer help. website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process effectively. Don’t hesitate to contact us for personalized solutions; we are here to assist you whenever necessary!

What is GST?

GST, which stands for Goods and Services Tax, is an integrated indirect tax that applies to the supply of goods and services across India. It replaced various other forms of indirect taxes like VAT, excise duty as well as service tax.

Why was GST introduced in India?

The purpose of implementing GST was to streamline the complex structure of indirect taxes, eradicate tax cascade impact, facilitate business operations and establish a uniform marketplace across the nation.

What are the different types of GST?

India’s GST is classified into four forms- CGST (Central Goods and Services Tax), SGST (State Goods and Services Tax), IGST (Integrated Goods, and Services Tax) as well as UTGST (Union Territory Good and Service tax).

What is the GST rate structure in India?

Depending on the type of goods or services, GST rates in India will differ. There are four main tax slabs: 5%, 12%, 18% and 28%. Certain essential items fall under a zero percent tax bracket while some products attract an additional cess.

How does GST impact exports and imports?

Under GST, the export of goods and services is categorized as zero-rated, which implies that no tax shall be imposed on exports. Conversely, imports are liable to IGST upon arrival in India.

ALSO READ What is CAA

Court Marriage Process in India

- AFSPA Act

AFSPA act mean Armed Forces Special Powers Act (AFSPA) grants special powers to the Indian Armed Forces in areas classified as “disturbed” due to significant insurgency or internal disturbances.

AFSPA act mean Armed Forces Special Powers Act (AFSPA) grants special powers to the Indian Armed Forces in areas classified as “disturbed” due to significant insurgency or internal disturbances. - Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent the balance achieved through the citizens’ right to access information.

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent the balance achieved through the citizens’ right to access information. - What is Article 371 of Indian Constitution ?Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

- Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are implemented effectively while granting rights like maternal leave entitlements. Abiding by these principles promulgates an impartial work culture encapsulating upright conduct; thereby cultivating conducive surroundings for progressive development.

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are implemented effectively while granting rights like maternal leave entitlements. Abiding by these principles promulgates an impartial work culture encapsulating upright conduct; thereby cultivating conducive surroundings for progressive development. - GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could get confusing. Now, with GST, it’s like combining all those taxes into one. The idea is to make taxes more straightforward, clear, and fair for everyone. It applies to almost everything we buy or sell, and it’s helping India’s businesses and economy work better together. So, GST is not just a tax change; it’s a step towards making things simpler and better for all of us.

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could get confusing. Now, with GST, it’s like combining all those taxes into one. The idea is to make taxes more straightforward, clear, and fair for everyone. It applies to almost everything we buy or sell, and it’s helping India’s businesses and economy work better together. So, GST is not just a tax change; it’s a step towards making things simpler and better for all of us.