Introduction of 240 IPC

IPC 240 punishes individuals who knowingly deliver, pass, or exchange counterfeit Indian coins. If a person has a fake coin and is aware that it is not genuine but still uses it in transactions, they will be held legally responsible under this section. This law prevents the spread of counterfeit currency and protects the economy from fraud.

- Introduction of 240 IPC

- What is IPC Section 240 ?

- Section 240 IPC in Simple Points

- Section 240 IPC Overview

- 10 Key Points on IPC 240

- Examples of IPC 240

- Section 240 IPC case laws

- 240 IPC Punishment

- 240 IPC Bailable or non bailable

- Section 240 IPC in short information

- IPC Section 240 FAQs

- If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

What is IPC Section 240 ?

IPC 240 states that if a person possesses a counterfeit Indian coin and delivers it to someone else, knowing it is not genuine, they are punishable by law. The offense is serious because it harms the economy and public trust in money.

Section 240 IPC in Simple Points

1. Delivering a Fake Coin is a Crime

If a person knowingly gives, sells, or exchanges a fake Indian coin, they can be punished under IPC 240. The law applies whether the fake coin is given for free or in a transaction. This section ensures that people do not circulate counterfeit money and harm the economy.

2. Knowledge of Counterfeit Nature is Important

For a person to be guilty under IPC 240, they must know that the coin is fake. If someone unknowingly delivers a counterfeit coin, they cannot be punished under this section. However, if the prosecution proves that the person was aware of the fake coin, they will be held responsible.

3. Punishment for Delivering Fake Coins

Under IPC 240, the accused can face imprisonment of up to 5 years and may also have to pay a fine. The severity of the punishment depends on the number of fake coins delivered and the intent behind the act. The court decides the punishment based on the seriousness of the offense.

4. IPC 240 is a Serious and Non-Bailable Offense

Since counterfeit money can harm the financial system, this crime is treated seriously. IPC 240 is a non-bailable offense, meaning the accused cannot get bail easily. The police can arrest the person without a warrant, making it a cognizable offense.

5. Applies Only to Indian Coins

This law only applies to Indian coins. If a person is caught delivering counterfeit foreign coins, they will not be punished under IPC 240 but may be charged under other sections of the law. The purpose of this section is to protect India’s currency system from fraud and illegal activities.

Section 240 IPC Overview

IPC 240 punishes a person who delivers, gives, or passes off a counterfeit Indian coin while knowing that it is fake. This law ensures that individuals who circulate fake currency knowingly are held accountable.

10 Key Points on IPC 240

1. Meaning of IPC 240

IPC 240 applies when a person delivers or gives a counterfeit Indian coin to someone else while knowing it is fake. The person does not need to have made the fake coin, but if they knowingly use it, they are guilty.

2. Protecting the Economy

Circulating counterfeit coins weakens the financial system. If fake money is used widely, it reduces trust in real currency, which can harm businesses and daily transactions. IPC 240 helps prevent this damage.

3. Difference Between IPC 239 and IPC 240

IPC 239 deals with any type of counterfeit coins, while IPC 240 applies only to counterfeit Indian coins. If a person delivers fake Indian currency knowingly, IPC 240 is used instead of IPC 239.

4. Intent is Important

A person cannot be punished under IPC 240 if they unknowingly receive or use a fake coin. The law applies only when a person is aware that the coin is counterfeit but still uses it.

5. No Need for Large-Scale Crime

Even if a person passes just one fake coin, they can be charged under IPC 240. The law does not require a person to be involved in a large counterfeit money operation.

6. Punishment for Offense

If found guilty, the punishment for IPC 240 includes imprisonment of up to five years or a monetary fine, or both. This ensures strict action against those spreading fake currency.

7. Cognizable and Non-Bailable Offense

IPC 240 is a cognizable offense, meaning police can arrest the person without a warrant. It is also non-bailable, meaning getting bail is difficult unless approved by the court.

8. Trial in Sessions Court

Cases under IPC 240 are handled by a Sessions Court, which deals with serious crimes. The court examines whether the accused knew the coins were fake and still used them.

9. Proof of Knowledge is Important

To convict a person under IPC 240, the prosecution must prove that the accused knew the coin was fake. If a person was unaware, they cannot be punished under this law.

10. How to Avoid IPC 240 Charges

If someone unknowingly receives a fake coin, they should report it to the police or a bank immediately. Keeping or using counterfeit coins can lead to legal trouble, even if done accidentally.

Examples of IPC 240

Example 1: Shopkeeper Caught with Fake Coins

Ravi, a shopkeeper, was found giving fake Rs. 10 coins to customers. He had received these counterfeit coins from a supplier and was aware they were not real. A customer noticed the coins were lighter than usual and reported it to the police. Ravi was arrested under IPC 240 for knowingly delivering counterfeit coins and was later sentenced to 3 years in prison.

Example 2: Fake Coins Used in a Market

Anil bought a bag of fake Rs. 5 coins from an illegal source and started using them at a local vegetable market. The vegetable seller noticed that the coins looked suspicious and reported it. The police investigated and found dozens of fake coins with Anil. Since he knew the coins were counterfeit but still used them, he was charged under IPC 240 and fined Rs. 20,000 with 2 years of jail time.

Section 240 IPC case laws

1. State vs. Ramesh Kumar (2010)

Facts: Ramesh Kumar was caught trying to exchange 50 fake Rs. 10 coins at a local shop. The shopkeeper noticed the coins were suspicious and reported him.

Result: The court convicted Ramesh Kumar under IPC 240, sentencing him to 3 years in prison and a fine of Rs. 10,000.

2. Police vs. Anil Sharma (2015)

Facts: Anil Sharma was found circulating counterfeit Rs. 5 coins in public markets. He claimed he did not know they were fake.

Result: The court ruled that since there was no evidence that Anil knew the coins were fake, he was not convicted under IPC 240.

3. State of Maharashtra vs. Mohan Yadav (2018)

Facts: Mohan Yadav was part of a gang importing fake Indian coins from a foreign country and delivering them in India.

Result: The court convicted him and sentenced him to 5 years in prison under IPC 240.

4. Ravi Verma vs. State of Uttar Pradesh (2021)

Facts: Ravi Verma was caught distributing counterfeit Rs. 2 coins at a railway station. Police found hundreds of fake coins in his bag.

Result: The court found him guilty under IPC 240 and sentenced him to 4 years of imprisonment with a Rs. 15,000 fine.

5. Government of India vs. Arjun Patel (2022)

Facts: Arjun Patel was accused of giving fake Rs. 10 coins to school children in exchange for real notes.

Result: The court ruled that since Arjun knowingly distributed fake coins, he was sentenced to 3 years in prison.

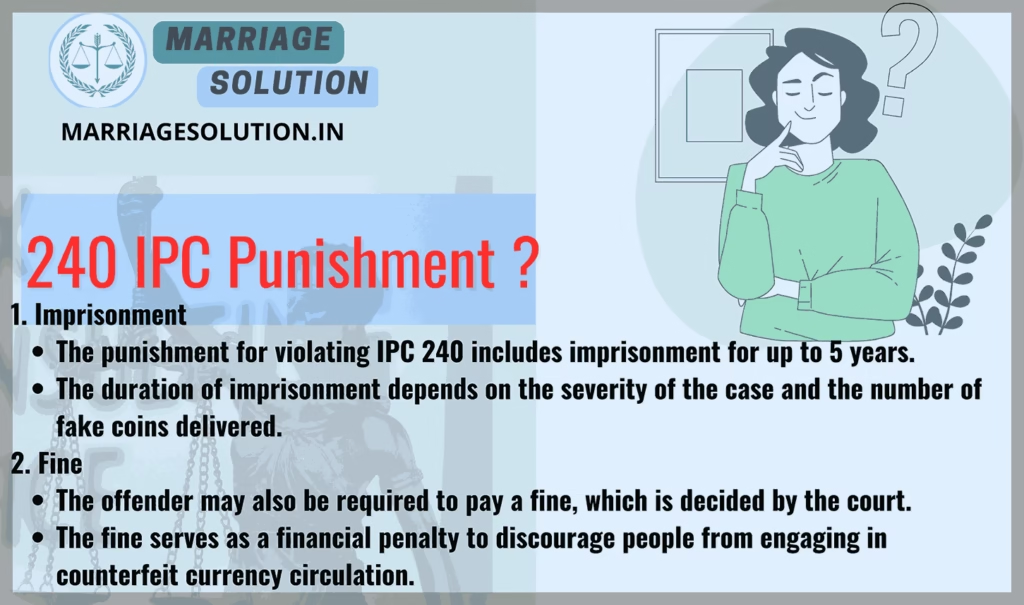

240 IPC Punishment

1. Imprisonment

- The punishment for violating IPC 240 includes imprisonment for up to 5 years.

- The duration of imprisonment depends on the severity of the case and the number of fake coins delivered.

2. Fine

- The offender may also be required to pay a fine, which is decided by the court.

- The fine serves as a financial penalty to discourage people from engaging in counterfeit currency circulation.

240 IPC Bailable or non bailable

- IPC 240 is a non-bailable offense, meaning bail is not granted easily.

- The accused must apply for bail in court, and the judge will decide based on the case details.

- Since counterfeit currency affects the financial system, strict laws apply to prevent further damage.

- The offense is serious, and the accused may be kept in custody until trial.

Section 240 IPC in short information

| IPC Section | Offense | Punishment | Bailable/Non-Bailable | Cognizable/Non-Cognizable | Trial By |

|---|---|---|---|---|---|

| IPC 240 | Delivering counterfeit Indian coin while knowing it is fake | Up to 5 years imprisonment and/or fine | Non-Bailable | Cognizable | Sessions Court |

IPC Section 240 FAQs

What happens if someone unknowingly delivers a fake coin?

If a person does not know that the coin is fake, they will not be punished under IPC 240. The law applies only when the person is aware of the counterfeit nature of the coin.

Can a person be punished for using just one fake coin?

Yes, even if one counterfeit Indian coin is knowingly used, the person can be charged under IPC 240.

What if someone receives a fake coin as change and uses it later?

If a person unknowingly receives a fake coin and uses it without knowledge, they cannot be punished under IPC 240.

Is IPC 240 applicable to all types of coins

No, IPC 240 applies only to counterfeit Indian coins. If a person delivers fake foreign coins, IPC 239 may apply instead.

Can a person be arrested immediately under IPC 240?

Yes, IPC 240 is a cognizable offense, meaning police can arrest the accused without a warrant.

If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

Court or any other marriage-related issues, our https://marriagesolution.in/lawyer-help-1/ website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process.

Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent…

What is Article 371 of Indian Constitution ?

Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are…

GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could…