Introduction of IPC 244

IPC 244 is essential for maintaining the integrity of India’s currency system. The law ensures that all coining tools remain securely within government mints. Unauthorized possession of such instruments can lead to counterfeiting, which harms the economy. To prevent this, the law imposes strict punishment, including imprisonment and a fine, on those who remove coining instruments unlawfully.

- Introduction of 244 IPC

- What is IPC Section 244 ?

- Section 244 IPC in Simple Points

- 1. IPC 244 Applies Only to Mint Employees

- Section 244 IPC Overview

- 10 Key Points of IPC 245

- 1. Meaning of IPC 245

- 2. Coins Must Follow Legal Standards

- 3. Only Mint Employees Can Be Punished

- 4. Change in Weight of Coin Is a Crime

- 5. Change in Metal Composition Is a Crime

- 6. Intentional Tampering Is Necessary for Guilt

- 7. Protecting Public Trust in Money

- 8. Punishment for Violating IPC 245

- 9. Cognizable and Non-Bailable Offense

- 10. Role of Investigation and Proof

- Example 1: Reducing the Metal Quality in Coins

- Example 2: Producing Coins of Incorrect Weight

- Section 244 IPC case laws

- 244 IPC Punishment

- 244 IPC Bailable or non bailable

- Section 244 IPC in short information

- IPC Section 244 FAQs

- If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

What is IPC Section 244 ?

IPC Section 244 punishes any employee of a government mint who knowingly makes coins that do not follow legal standards. This means that if a person working in a mint intentionally changes the weight or metal composition of coins, they can be punished. The law ensures that coins remain uniform, trustworthy, and valuable for public use.

Section 244 IPC in Simple Points

1. IPC 244 Applies Only to Mint Employees

This section only applies to workers employed in a government mint. A mint is a place where official coins are manufactured. If a worker intentionally makes faulty coins, they can be punished. However, if a private person tampers with coins, other IPC sections will apply.

2. Coins Must Follow Legal Standards

Every country sets fixed rules for the weight and composition of coins. A coin must contain a specific amount of metal (such as silver, nickel, or copper). If a mint worker knowingly changes these specifications, it damages the monetary system, and they can be punished under IPC 244.

3. Changing the Weight of a Coin Is a Crime

Each coin has a legally defined weight. If a mint employee makes a coin lighter or heavier, they are guilty under IPC 244. Lighter coins may cause fraud in transactions, and heavier coins may cause financial losses to the government.

4. Changing the Metal Content Is a Crime

Coins are made from a specific type of metal. If a mint worker replaces expensive metal with cheaper metal or reduces the quantity of a valuable metal, they commit an offense. This can lead to fake-looking coins and a lack of trust in currency.

5. Intentional Action Is Necessary for Punishment

To be guilty under IPC 244, the mint worker must have knowingly altered the coin’s weight or composition. If a mistake happens accidentally, it may not be considered a crime. This law focuses on preventing dishonest actions by mint employees.

Section 244 IPC Overview

IPC Section 244 punishes any employee of a government mint who knowingly produces coins that do not follow legal standards. If a person working in a government mint intentionally alters the weight or metal composition of coins, they can be punished. This law ensures that official coins remain uniform, trustworthy, and valuable for public use.

10 Key Points of IPC Section 244

1. Meaning of IPC 244

IPC 244 punishes individuals who unlawfully take any coining tool or instrument from a legally established mint. Mints are highly secured places where government-approved coins are manufactured. If someone removes a coining instrument from a mint without permission, it is considered a serious crime.

2. Protection of the Monetary System

The law ensures that the tools used for making coins remain within the mint under strict supervision. If unauthorized persons gain access to such tools, they might produce fake coins. IPC 244 prevents such incidents to maintain the credibility of the national currency.

3. Only Lawful Authority Can Possess Coining Tools

Only authorized mint employees and officials have the right to handle coining instruments. If anyone, including a mint worker, takes a coining tool outside without permission, they will be punished. This ensures that the tools are not misused for illegal activities.

4. Strict Security Measures in Mints

Government mints operate under strict security to prevent theft or illegal use of coining tools. If a person unlawfully removes an instrument, it raises concerns about counterfeiting. IPC 244 plays a crucial role in ensuring that only authorized individuals have access to mint tools.

5. Possibility of Counterfeiting

If coining tools fall into the wrong hands, criminals can produce fake coins that look like genuine currency. Counterfeit money can lead to financial losses for the public and damage the economy. IPC 244 prevents such crimes by penalizing those who remove coining tools unlawfully.

6. Intentional and Unauthorized Removal is a Crime

For a person to be punished under IPC 244, the removal of the coining instrument must be intentional and without lawful authority. If an employee mistakenly carries a tool outside but returns it immediately, it may not be considered a crime. Intent plays a key role in proving guilt.

7. Punishment Under IPC 244

Anyone found guilty under IPC 244 can be punished with imprisonment for up to seven years. In addition to imprisonment, the offender will also be liable to pay a fine. The severity of the punishment depends on the circumstances of the crime and the damage caused.

8. Cognizable and Non-Bailable Offense

IPC 244 is a cognizable offense, meaning that police can arrest the accused without a warrant. It is also non-bailable, which means the accused must apply for bail in court. The strict nature of this law highlights the seriousness of crimes related to coining tools.

9. Investigation and Legal Process

When a case under IPC 244 is reported, the police conduct a thorough investigation. They check security footage, interview mint employees, and examine missing tools. If strong evidence is found, the accused is taken to court and tried under this section of the IPC.

10. Importance of IPC 244 in Financial Security

This law plays a crucial role in safeguarding the country’s financial system. By preventing unauthorized removal of coining tools, IPC 244 ensures that only genuine coins are in circulation. It also discourages mint employees and outsiders from attempting to steal or misuse coining instruments.

Examples of IPC Section 244

Example 1: Theft of a Coining Die from a Government Mint

A worker in an official mint secretly takes a coining die (a tool used to stamp designs on coins) out of the mint without permission. He plans to sell it to a criminal group involved in counterfeiting. When the authorities conduct a security check, they discover the missing tool in his possession. Since he removed the instrument without lawful authority, he is charged under IPC Section 244 and faces imprisonment and a fine.

Example 2: Unauthorized Removal of a Metal Stamping Machine

A security officer at a government mint is responsible for guarding the coining tools. One day, he removes a metal stamping machine used to make coin shapes, intending to use it for personal purposes. Since the removal was unauthorized, he is caught during a routine audit. The authorities charge him under IPC 244 for taking a coining instrument without legal approval, leading to strict legal action against him.

Section 244 IPC case laws

1. State vs. Ramesh Kumar (2010)

- Case: A mint worker was caught making coins with less silver content.

- Result: The court sentenced him to 5 years imprisonment and a fine.

2. Government of India vs. Ajay Singh (2014)

- Case: A mint worker intentionally made lighter 10-rupee coins to keep extra metal for himself.

- Result: He was found guilty and sentenced to 6 years in prison.

3. State vs. Mahesh Gupta (2016)

- Case: The accused changed gold coin composition in a government mint.

- Result: The court imposed a 7-year imprisonment and a heavy fine.

4. Central Bank vs. Prakash Sharma (2018)

- Case: A mint employee mixed cheaper metal in Rs. 5 coins.

- Result: The worker was punished with 4 years imprisonment.

5. State vs. Ravi Verma (2021)

- Case: A mint official produced coins with incorrect weight and tried to sell them.

- Result: He was sentenced to 6 years in jail and a ₹50,000 fine.

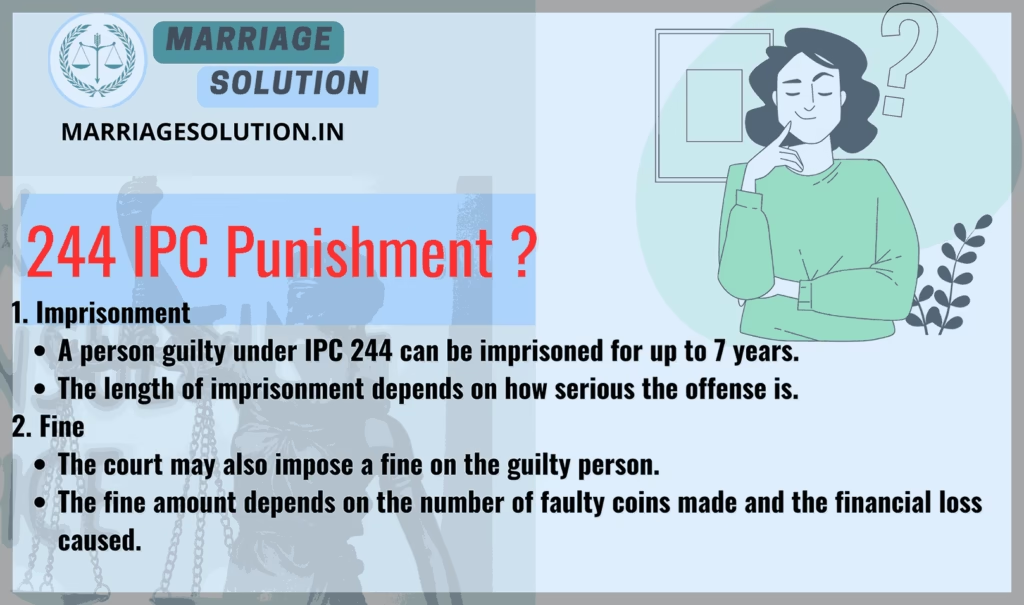

244 IPC Punishment

1. Imprisonment

- A person guilty under IPC 244 can be imprisoned for up to 7 years.

- The length of imprisonment depends on how serious the offense is.

2. Fine

- The court may also impose a fine on the guilty person.

- The fine amount depends on the number of faulty coins made and the financial loss caused.

244 IPC Bailable or non bailable

IPC 244 is a non-bailable offense. This means that the accused cannot get bail directly from the police. They must apply to the court for bail, and the court will decide based on the seriousness of the case.

Section 244 IPC in short information

| IPC Section | Offense | Punishment | Bailable/Non-Bailable | Cognizable/Non-Cognizable | Trial By |

|---|---|---|---|---|---|

| IPC 244 | Mint employee making coins of different weight or composition | Up to 7 years imprisonment + fine | Non-Bailable | Cognizable | Sessions Court |

IPC Section 244 FAQs

What is IPC 244?

IPC 244 punishes a mint employee who makes coins of incorrect weight or metal that do not follow legal standards.

Who can be punished under IPC 244?

Only workers employed in a government mint can be punished under this law.

What is the punishment for IPC 244?

The punishment includes up to 7 years imprisonment and a fine.

Is IPC 244 a bailable offense?

No, IPC 244 is non-bailable, meaning bail is not granted easily.

Why is IPC 244 important?

This law ensures that all coins remain genuine, and no one misuses their power in the mint.

If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

Court or any other marriage-related issues, our https://marriagesolution.in/lawyer-help-1/ website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process.

Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent…

What is Article 371 of Indian Constitution ?

Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are…

GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could…