Introduction of 322 BNS

322 BNS deals with dishonest or fraudulent actions during the execution of deeds or instruments involving property. It focuses on preventing false statements about the consideration (value) or intended beneficiaries in such transactions. This law ensures transparency and fairness in property dealings by penalizing fraudulent practices with imprisonment, fines, or both.

The Bharatiya Nyaya Sanhita (BNS) Section 322 replaces the old Indian Penal Code (IPC) Section 423.

- Introduction of 322 BNS

- What is BNS Section 322 ?

- 322 BNS act in Simple Points

- Section 322 BNS Overview

- Detailed Explanation of 10 Key Points

- 1. Purpose of BNS Section 322

- 2. Definition of Fraudulent Deeds

- 3. Coverage of Property Transactions

- 4. Inclusion of All Offender

- 5. Punishment for Offense

- 6. Protection Against False Beneficiaries

- 7. Transparency in Financial Consideration

- 8. Classification of the Offense

- 9. Ensuring Legal Property Transfers

- 10. Scope of Protection for Affected Parties

- BNS Section 322: 2 Examples

- Detailed Explanation of 10 Key Points

- 322 BNS Punishment

- 322 BNS bailable or not ?

- Bharatiya Nyaya Sanhita Section 322

- BNS Section 322 FAQs

- If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

What is BNS Section 322 ?

BNS Section 322 addresses cases where a person dishonestly or fraudulently participates in signing, executing, or being a party to any deed or instrument that transfers or imposes a charge on property and contains false information regarding the consideration or the intended beneficiary. This ensures that property transfers are transparent and truthful.

322 BNS act in Simple Points

1. Focus on False Statements in Property Deeds

This section primarily targets the dishonesty or fraud involved in deeds or instruments transferring property. If false claims regarding the consideration (price, amount, etc.) or the intended beneficiary are included, it becomes a punishable offense. This safeguards genuine transactions and ensures truthful documentation in legal property matters.

2. Applicability to All Parties in the Deed

The law applies to everyone involved in the fraudulent deed, including those who sign, execute, or actively participate in creating or transferring the property. For example, if multiple people conspire to falsely transfer ownership, all participants can be held liable under this section.

3. Protection Against Fraudulent Transfers

The section is a safeguard for genuine property owners, buyers, and beneficiaries. It prevents fraudulent activities where properties are transferred or charged using deceitful claims, protecting the integrity of property ownership and financial transactions.

4. Punishment as a Deterrent

This section prescribes punishment of up to three years of imprisonment, a fine, or both. This acts as a deterrent for those intending to defraud others through false property documentation. The severity of the penalty varies based on the case’s complexity and damage caused.

5. Legal Classification of the Offense

The offense is:

- Non-Cognizable: Police cannot initiate an investigation without Magistrate approval.

- Bailable: The accused has the right to apply for bail.

- Non-Compoundable: The case cannot be settled between parties without a court trial.

This classification ensures due legal process for all parties involved.

Section 322 BNS Overview

BNS Section 322 deals with fraudulent actions in property transfer deeds. If someone dishonestly or fraudulently signs, executes, or becomes a party to a deed that falsely claims certain financial considerations or benefits to individuals, they are liable for punishment. This section ensures fairness and truthfulness in property transactions.

Detailed Explanation of 10 Key Points

1. Purpose of BNS Section 322

This section is designed to ensure transparency and honesty in property transactions. It penalizes those who create or sign property deeds with false statements about the consideration (monetary or otherwise) or intended beneficiaries. By doing so, it safeguards the rights of creditors, lawful property owners, and other parties involved in transactions.

2. Definition of Fraudulent Deeds

The offense involves signing, executing, or being part of a deed or instrument that falsely represents property-related facts. These falsehoods may pertain to the amount paid or the individual for whom the deed is intended. The law ensures that only legitimate claims and considerations are reflected in property-related documents.

3. Coverage of Property Transactions

This section applies to any deed or instrument involving property transfers or charges. These transactions can include sales, mortgages, or leases. The aim is to prevent fraudulent activities that can disrupt the equitable distribution of assets or result in financial loss for other parties.

4. Inclusion of All Offender

The law holds accountable not just the person creating or signing the deed but also any individual knowingly participating in the fraudulent activity. This ensures that all parties to the fraud, including accomplices and beneficiaries of the false deed, face legal consequences.

5. Punishment for Offense

The punishment for violating BNS Section 322 includes:

- Imprisonment of up to three years.

- A fine, the amount of which depends on the court’s discretion.

- Both imprisonment and fine, depending on the severity and impact of the offense.

This penalty acts as a deterrent against fraudulent property transactions.

6. Protection Against False Beneficiaries

The section specifically targets fraudulent deeds that falsely identify the intended beneficiary. For example, creating a deed that names a fake person as the property owner to evade taxes or mislead creditors is punishable. This protects the rights of genuine beneficiaries and legal stakeholders.

7. Transparency in Financial Consideration

By penalizing false statements about the consideration involved, such as claiming a higher or lower sale value, this law promotes transparency in financial transactions. It also reduces the risk of tax evasion and ensures accurate documentation of property values.

8. Classification of the Offense

- Non-Cognizable: Police need Magistrate approval to investigate.

- Bailable: The accused has the right to seek bail.

- Non-Compoundable: The case cannot be resolved privately; a court trial is mandatory.

This classification ensures a balanced legal approach while preserving the rights of all involved parties.

9. Ensuring Legal Property Transfers

This section reinforces the legal framework for property transactions by penalizing dishonest practices. It protects individuals and institutions from being misled by fraudulent deeds, fostering trust in the property market and legal system.

10. Scope of Protection for Affected Parties

BNS Section 322 not only punishes the offenders but also safeguards the interests of creditors, rightful owners, and financial institutions. By discouraging fraudulent property deeds, it ensures that assets are distributed and managed fairly according to the law.

BNS Section 322: 2 Examples

Example 1:

A creates a property sale deed claiming the property is sold for ₹10 lakhs, but the actual consideration was ₹20 lakhs to evade taxes. This false statement about the consideration violates BNS Section 322.

Example 2:

B transfers ownership of a plot of land through a deed falsely naming a friend as the new owner to hide the property from creditors. This fraudulent representation of the beneficiary is punishable under this section.

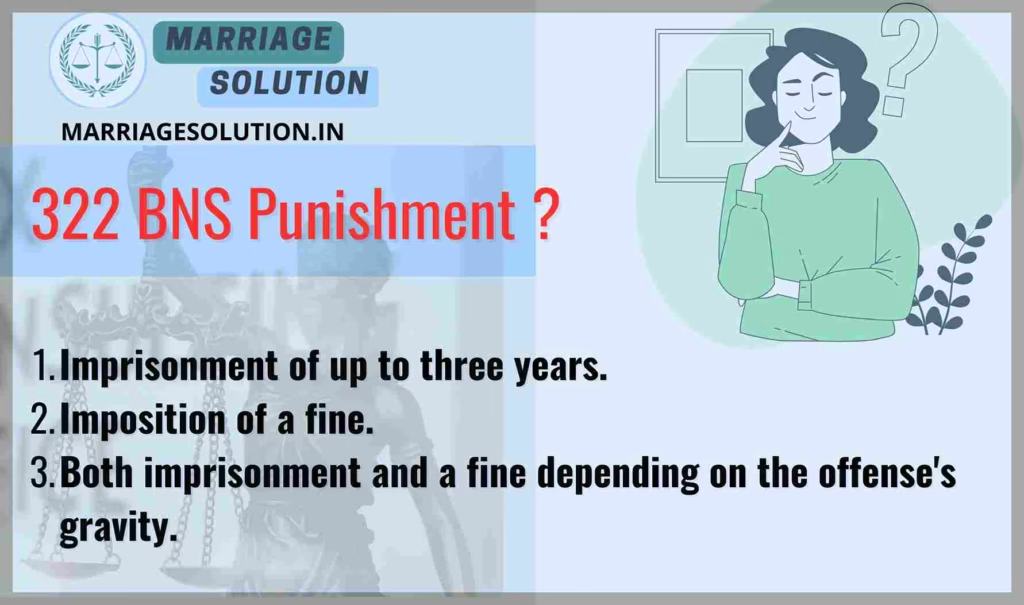

322 BNS Punishment

- Imprisonment of up to three years.

- Imposition of a fine.

- Both imprisonment and a fine depending on the offense’s gravity.

322 BNS bailable or not ?

- Bailable: The accused has the right to seek bail.

- The offense is non-cognizable, meaning the police need Magistrate approval to investigate.

- The trial is conducted by any Magistrate.

Bharatiya Nyaya Sanhita Section 322

| Points | Details |

|---|---|

| Offense | Dishonest or fraudulent execution of a deed of transfer containing false statements. |

| Punishment | Imprisonment up to 3 years, fine, or both. |

| Bailable/Non-Bailable | Bailable |

| Cognizable/Non-Cognizable | Non-Cognizable |

| Trial by | Any Magistrate |

BNS Section 322 FAQs

1. What does BNS Section 322 address?

BNS Section 322 penalizes individuals who execute deeds or instruments involving property with false statements about the value or intended beneficiaries of the transaction.

2. What is the punishment under BNS Section 322?

The punishment can extend up to 3 years of imprisonment, a fine, or both, depending on the case’s severity.

3. Is BNS Section 322 bailable?

Yes, the offense is bailable, allowing the accused to seek bail during the legal process.

4. What type of offense is classified under this BNS 322?

The offense is non-cognizable, bailable, and non-compoundable, requiring a trial before a Magistrate.

5. Can a case under BNS Section 322 be settled privately?

No, the offense is non-compoundable, meaning it cannot be resolved through a private settlement and must go through a legal trial.

6. Who is held liable under this section?

Anyone who knowingly signs, executes, or participates in a fraudulent deed containing false statements is held liable under this section.

If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

Court or any other marriage-related issues, our https://marriagesolution.in/lawyer-help-1/ website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process.

Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent…

What is Article 371 of Indian Constitution ?

Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are…

GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could…