Introduction of BNS 180

BNS 180 deals with the possession of forged or counterfeit currency, government stamps, coins, or banknotes. This section is crucial as it addresses individuals who knowingly possess counterfeit items with the intent to use them as genuine or allow others to use them. The law recognizes this as a serious offense and outlines strict penalties for violators.

The Bharatiya Nyaya Sanhita (BNS) Section 180 replaces the old Indian Penal Code (IPC) Section 489-C.

- Introduction of BNS 180

- What is BNS Section 180 ?

- BNS 180 in Simple Points

- Section 180 BNS Overview

- BNS SECTION 180 :10 Key Points

- 1. Offense of Possession

- 2. Knowing or Having Reason to Believe

- 3. Intention to Use as Genuine

- 4. Scope of the Counterfeit Items

- 5. Punishment for the Offense

- 6. Legal Defense for Lawful Possession

- 7. Cognizable Offense

- 8. Non-bailable Offense

- 9. Trial by Court of Session

- 10. Non-compoundable Offense

- Example 1: Possession of Counterfeit Currency

- Example 2: Counterfeit Government Stamp

- BNS 180 Punishment

- BNS 180 bailable or not ?

- Bharatiya Nyaya Sanhita Section 180

- BNS Section 180 FAQs

- If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

What is BNS Section 180 ?

BNS Section 180 makes it an offense to possess any counterfeit or forged coin, government stamp, currency-note, or bank-note with the knowledge or reasonable suspicion that the item is counterfeit. The individual must also have the intent to use the counterfeit item as if it were genuine or to enable its use as a genuine item.

BNS 180 in Simple Points

- Possession of Forged or Counterfeit Items

- This section applies to anyone who possesses counterfeit coins, stamps, currency, or bank-notes, knowing that they are not genuine.

- Intent to Use or Enable Use

- The offense is complete if the person possessing the counterfeit items intends to use them as genuine or allows others to use them as genuine.

- Knowledge or Suspicion of Counterfeit Nature

- The law requires that the person either knows or has reason to believe that the items are counterfeit. Mere possession without knowledge is not a crime.

- Legal Defense for Lawful Possession

- If the accused can prove that they possessed the counterfeit items lawfully (for instance, for reporting to authorities), it is not considered an offense.

- Penalty

- A person found guilty under this section can be punished with imprisonment for up to 7 years, fined, or both.

Section 180 BNS Overview

180 addresses the offense of possessing forged or counterfeit coins, government stamps, currency-notes, or banknotes with the intention of using them as genuine. This section is crucial for maintaining the integrity of the currency system and punishing those who knowingly hold counterfeit items. Here are 10 key points that explain this section in detail:

BNS SECTION 180 :10 Key Points

1. Offense of Possession

- What it covers: BNS Section 180 specifically applies to individuals who possess counterfeit or forged items such as coins, government stamps, currency-notes, or banknotes. The possession itself, if done knowingly, is considered a crime.

- Importance: This section ensures that people who come into contact with counterfeit items, whether by accident or on purpose, are held accountable if they intend to use these items as genuine.

2. Knowing or Having Reason to Believe

- Explanation: To be prosecuted under this section, the individual must either know or have reason to believe that the items in their possession are counterfeit.

- Detail: If someone unintentionally receives a counterfeit note and is unaware of its nature, they are not liable. However, if there are clear signs that the items are forged (such as poor quality or incorrect designs) and the person still holds them, they may be charged.

3. Intention to Use as Genuine

- What it means: The individual must have the intention to use the counterfeit items as if they were genuine, or they must intend to enable others to use them as genuine.

- Example: If a person knowingly holds counterfeit currency and plans to use it in a transaction, this is enough to prove intent, making them liable under the law.

4. Scope of the Counterfeit Items

- Covered items: This section covers forged or counterfeit coins, government stamps, currency-notes, and banknotes.

- Relevance: The broad scope ensures that all forms of currency and stamps are protected, covering both traditional coins and modern banknotes.

5. Punishment for the Offense

Imprisonment: If found guilty, the person may face imprisonment for up to seven years.

- Fine: In addition to imprisonment, they may also be fined, or both penalties may be applied simultaneously.

- Details: The severity of the punishment depends on the circumstances of the case, such as the amount of counterfeit currency and the intent behind possessing it.

6. Legal Defense for Lawful Possession

- What it provides: If a person can prove that their possession of the counterfeit items was lawful, they are not liable for the offense.

- Explanation: For instance, if someone possesses counterfeit currency with the intent to report it to the authorities, they can avoid criminal liability. The burden is on the individual to establish this lawful purpose.

7. Cognizable Offense

Meaning: BNS Section 180 classifies the possession of counterfeit items as a cognizable offense.

- Police Powers: This means that the police can arrest the individual without a warrant if they have reason to believe the person is involved in the offense.

8. Non-bailable Offense

- Explanation: This section is categorized as a non-bailable offense, meaning that the accused cannot secure bail as a matter of right.

- Detail: The court will decide whether to grant bail based on the specifics of the case, and bail may not be granted easily due to the seriousness of the offense.

9. Trial by Court of Session

Court of Session: Cases under BNS Section 180 are triable by a Court of Session, which handles more serious offenses.

- Explanation: The trial must be conducted in a higher court, reflecting the gravity of the crime and the potential severity of the punishment.

10. Non-compoundable Offense

What it means: The offense is non-compoundable, meaning that the case cannot be settled between the accused and the complainant.

- Explanation: Once charged, the case must go through the legal process, and no out-of-court settlement can be made to drop the charges.

Example 1: Possession of Counterfeit Currency

Rajesh, a shopkeeper, receives a fake ₹500 note as part of a transaction. After realizing the note is counterfeit, he decides not to report it to the police. Instead, he plans to use the counterfeit note at another shop to avoid the loss. Under BNS Section 180, Rajesh is committing an offense by knowingly possessing and intending to use the fake currency as genuine.

Example 2: Counterfeit Government Stamp

Sunita buys property and needs to pay stamp duty. She receives a forged government stamp from a friend who tells her it’s cheaper but works the same way. Sunita knows the stamp is fake but uses it to complete the transaction. Under BNS Section 180, Sunita is liable for possessing and using a counterfeit government stamp, which is a punishable offense.

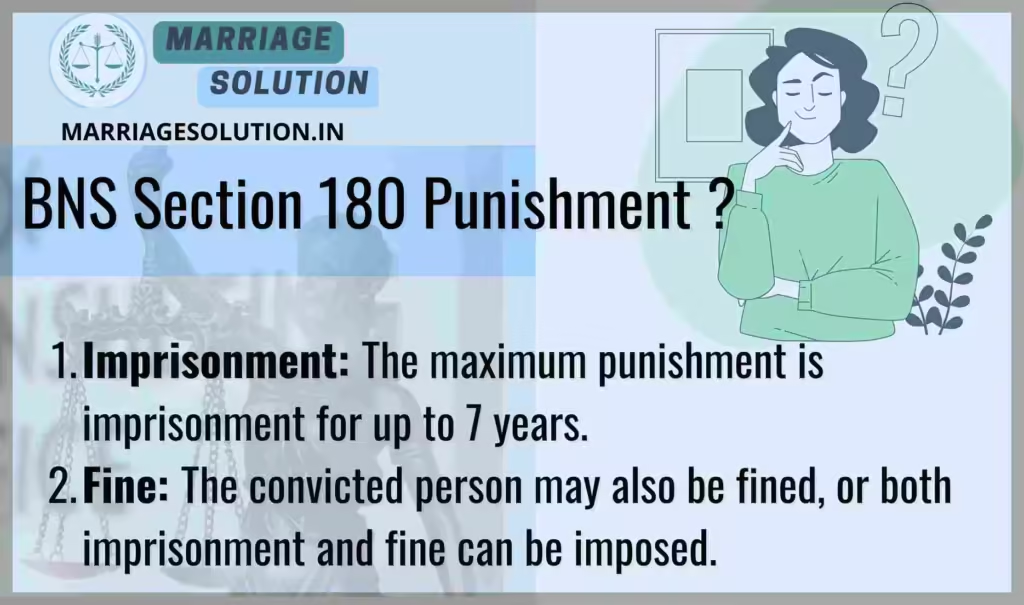

BNS 180 Punishment

Imprisonment: The maximum punishment is imprisonment for up to 7 years.

Fine: The convicted person may also be fined, or both imprisonment and fine can be imposed.

BNS 180 bailable or not ?

No, BNS Section 180 is non-bailable. This means that the accused cannot automatically get bail but must apply to a higher court, which will decide whether bail is granted based on the case’s merits.

Bharatiya Nyaya Sanhita Section 180

| Offense | Punishment | Classification | Bail | Trial Court |

|---|---|---|---|---|

| Possession of forged or counterfeit items | Imprisonment up to 7 years, or fine, or both | Cognizable | Non-bailable | Court of Session |

BNS Section 180 FAQs

What constitutes an offense under BNS Section 180?

Possessing counterfeit currency, coins, or stamps while knowing or having reason to believe they are fake, with the intention of using them as genuine.

What is the punishment for violating BNS Section 180?

The punishment can be imprisonment for up to 7 years, a fine, or both.

Is BNS Section 180 a cognizable offense?

Yes, it is a cognizable offense, meaning the police can arrest without a warrant.

Is BNS Section 180 a bailable offense?

No, it is non-bailable, meaning bail is not automatically granted and must be applied for in court.

Which court handles trials under BNS Section 180?

Trials under this section are held in the Court of Session.

What defense can be used if charged under BNS Section 180?

A lawful defense can be established if the possession of counterfeit items is proven to be for legitimate purposes, such as reporting them to authorities.

If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

Court or any other marriage-related issues, our https://marriagesolution.in/lawyer-help-1/ website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process.

Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent…

What is Article 371 of Indian Constitution ?

Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are…

GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could…