Introduction of Section BNS 211

BNS 211 deals with situations where a person, who is legally required to give notice or information to a public servant, intentionally fails to do so. If someone does not provide this required information, they can be punished with imprisonment or a fine, depending on the seriousness of the situation. This section ensures people follow the law by giving important information to authorities when needed.

The Bharatiya Nyaya Sanhita (BNS) Section 211 replaces the old Indian Penal Code (IPC) Section 176.

- Introduction of Section BNS 211

- What is BNS Section 211 ?

- BNS 211 in Simple Points

- Section 211 BNS Overview

- BNS 211 Punishment

- BNS 211 bailable or not ?

- Bharatiya Nyaya Sanhita Section 211

- BNS Section 211 FAQs

- If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

What is BNS Section 211 ?

BNS Section 211 deals with the intentional omission by a person who is legally required to provide notice or information to a public servant. If someone deliberately fails to give such notice or furnish the necessary information at the time and in the manner required by law, they can face legal penalties. The severity of punishment depends on the type of information omitted, especially if it relates to the prevention or reporting of an offence.

BNS 211 in Simple Points

- Legal Obligation to Provide Notice or Information:

- If a person is legally bound to give notice or furnish information to a public servant, they must do so in the manner and at the time required by law. This obligation is crucial in ensuring that public officials can perform their duties effectively, such as enforcing laws, ensuring public safety, and handling criminal matters.

- Detailed Explanation: Legal obligations may arise in various scenarios, such as notifying authorities about public health concerns, reporting accidents, or providing information to prevent criminal activities. Failing to fulfill these responsibilities can lead to legal consequences under BNS Section 211.

- Intentional Omission of Duty:

- The omission must be intentional. If someone knowingly chooses not to provide the required notice or information despite being aware of their legal obligation, they can be charged under this section. Accidental or unintentional failure to provide the information may not lead to prosecution under BNS Section 211.

- Detailed Explanation: Intentional omission implies that the individual is aware of their duty but consciously neglects or refuses to fulfill it. This could involve situations where a person has information that could prevent a crime but decides not to inform the authorities.

- Punishment for General Omission (Clause a):

- When the omission is not related to a crime but involves failing to provide legally required notice or information, the punishment can be up to one month of simple imprisonment or a fine of ₹5,000, or both. This clause is aimed at holding individuals accountable for neglecting their general legal duties.

- Detailed Explanation: Even if the information is not critical for preventing a crime, it may still be important for other public duties like reporting accidents, public hazards, or health emergencies. Non-compliance with these duties can lead to punishment under this clause.

- Punishment for Omissions Related to Offences (Clause b):

- If the omission concerns an offence, either preventing it, reporting it, or assisting in the apprehension of an offender, the punishment becomes more severe. The person may face up to six months of simple imprisonment or a fine of ₹10,000, or both. This is to ensure that critical information related to public safety and criminal justice is not withheld.

- Detailed Explanation: Law enforcement and public authorities rely heavily on information to prevent crime or capture criminals. Deliberate failure to provide such information can significantly hamper public safety, which is why the penalties are higher for such omissions.

- Non-Cognizable and Bailable Nature of the Offence:

- BNS Section 211 is classified as non-cognizable and bailable. This means that the police cannot arrest the accused without a warrant, and the accused has the right to apply for bail. Non-cognizable offences are generally less severe, and the legal process must begin through the courts rather than direct police action.

- Detailed Explanation: Even though the offence under BNS Section 211 involves failing to provide important information, the non-cognizable nature reflects that it does not pose an immediate threat to public safety or security. However, the bailable status allows the accused to secure bail and await trial without being held in custody.

Section 211 BNS Overview

BNS Section 211 deals with the legal responsibility of a person to provide notice or information to a public servant when required by law. If someone is legally bound to give such information or notice but intentionally omits to do so, they can be punished. The severity of the punishment varies based on the nature of the information or notice and its significance, particularly if it relates to preventing or reporting an offence.

BNS Section 211 – Key Points Explained in Detail

- Legal Duty to Provide Notice or Information:

- Under BNS Section 211, a person who is legally required to provide notice or furnish information on any subject to a public servant must do so. The obligation arises from legal duties prescribed by law, where the information may be crucial for the performance of public duties.

- Example: A business owner is required to notify the authorities about hazardous chemicals stored on their property. Failure to provide such notice can lead to legal consequences under this section.

- Intentional Omission:

- The section applies when the omission to give notice or information is intentional. The individual must have knowingly chosen not to provide the required information. Accidental omissions do not fall under this category.

- Example: If a person fails to report knowledge of an upcoming criminal activity, despite knowing they are legally obligated to do so, they can be charged under this section.

- Punishment for General Omission (Clause a):

- If the omission does not relate to any offence but is a general failure to provide legally required information to a public servant, the individual can face simple imprisonment for up to one month or a fine of up to ₹5,000, or both.

- Example: A factory manager failing to report a fire incident to the local safety authority might face this level of punishment.

- Omission Related to Offence Prevention or Apprehension (Clause b):

- If the information or notice pertains to the commission of an offence, or is necessary for preventing a crime or for the apprehension of a criminal, the punishment becomes more severe. In such cases, the person can be imprisoned for up to six months or fined up to ₹10,000, or both.

- Example: Failing to inform the police about a suspect’s whereabouts, knowing that the information is crucial for apprehending a criminal, can result in imprisonment under this clause.

- Omission under Section 394 Order (Clause c):

- When the information or notice is required by an order passed under Section 394 of the Bharatiya Nagarik Suraksha Sanhita, 2023, the punishment can be imprisonment for up to six months or a fine of ₹1,000, or both. Section 394 typically involves orders related to public safety or government directives.

- Example: A shop owner who fails to notify local authorities about compliance with a government order regarding hazardous materials could be charged under this clause.

- Non-Cognizable Offence:

- The offence under BNS Section 211 is non-cognizable, meaning that the police cannot arrest the person without a warrant. Legal action must be initiated through the proper judicial process.

- Explanation: As the omission does not pose an immediate threat to public safety, it is classified as non-cognizable.

- Bailable Offence:

- The offence is bailable, which means that the accused can request bail and be released from custody while awaiting trial. Bail can be granted by the court handling the case.

- Explanation: Given the nature of the offence, it is categorized as bailable to allow the accused to continue with their daily life while the case is being processed.

- Non-Compoundable Offence:

- The offence is non-compoundable, which means that it cannot be settled between the parties outside the court. The matter must be resolved through a legal trial, ensuring that justice is upheld for violations of public duty.

- Explanation: As it involves a legal obligation to provide information that may affect public interest or safety, it cannot be privately settled.

- Jurisdiction and Trial by Magistrate:

- The offence is triable by any Magistrate, meaning that a Magistrate’s court will handle the trial and proceedings. The case will be tried in the jurisdiction where the omission occurred.

- Explanation: The court responsible for the jurisdiction where the omission took place will have the authority to hear the case and pass judgment.

- Importance of Compliance with Legal Duties:

- BNS Section 211 emphasizes the importance of complying with legal obligations to provide notice or information. Failure to comply can hinder public safety efforts, crime prevention, and judicial processes, making this section crucial for maintaining transparency and accountability in society.

- Explanation: This section ensures that individuals do not deliberately avoid providing critical information that could prevent harm or assist in legal processes.

Example of BNS Section 211

- Example 1: Failure to Notify Authorities About Dangerous Situation

- A factory owner is legally required to notify the fire department about the presence of hazardous materials in the building. Despite being fully aware of this obligation, the owner fails to provide this information. This intentional omission under BNS Section 211 could result in one month of imprisonment or a fine.

- Example 2: Not Reporting Information Related to a Crime

- A person has knowledge of a planned robbery and is legally obligated to inform the police. However, they intentionally omit to give this information, despite knowing it could prevent the crime. This falls under Clause (b) of BNS Section 211, and the person could face six months in prison or a fine of ₹10,000.

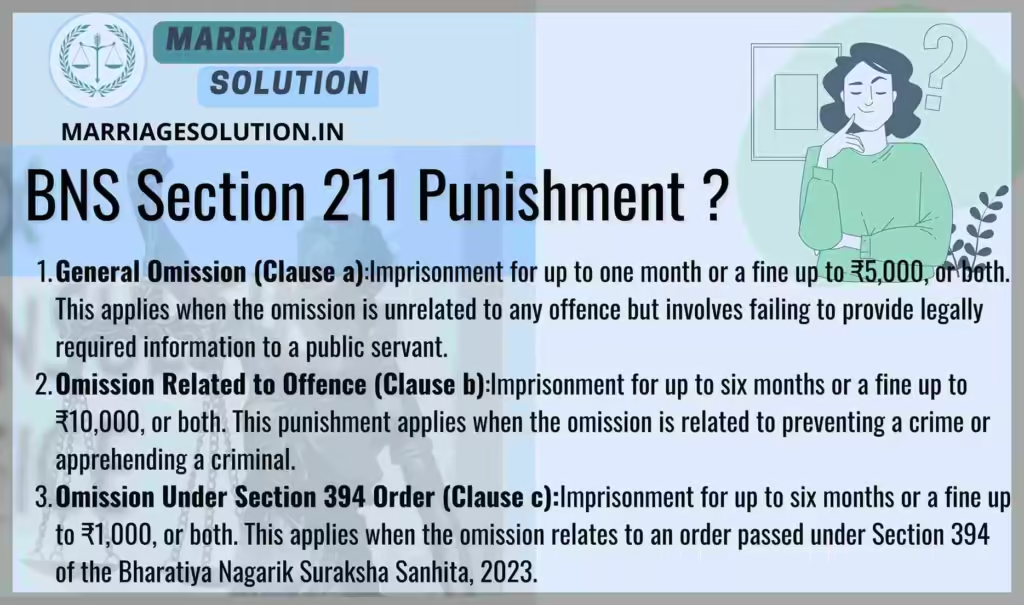

BNS 211 Punishment

- General Omission (Clause a):

- Imprisonment for up to one month or a fine up to ₹5,000, or both. This applies when the omission is unrelated to any offence but involves failing to provide legally required information to a public servant.

- Omission Related to Offence (Clause b):

- Imprisonment for up to six months or a fine up to ₹10,000, or both. This punishment applies when the omission is related to preventing a crime or apprehending a criminal.

- Omission Under Section 394 Order (Clause c):

- Imprisonment for up to six months or a fine up to ₹1,000, or both. This applies when the omission relates to an order passed under Section 394 of the Bharatiya Nagarik Suraksha Sanhita, 2023.

BNS 211 bailable or not ?

BNS Section 211 is a bailable offence, meaning that an individual charged under this section can apply for bail and be released from custody while awaiting trial.

Bharatiya Nyaya Sanhita Section 211

| Clause | Description | Punishment | Bailable | Cognizable | Trial By |

|---|---|---|---|---|---|

| 211 (General Omission) | Failure to provide notice or information to a public servant | Imprisonment for up to 1 month, or fine up to ₹5,000, or both | Yes | Non-cognizable | Any Magistrate |

| 211 (Offence Prevention) | Omission related to preventing crime or apprehending a criminal | Imprisonment for up to 6 months, or fine up to ₹10,000, or both | Yes | Non-cognizable | Any Magistrate |

| 211 (Section 394 Order) | Failure to provide notice or information as per Section 394 order | Imprisonment for up to 6 months, or fine up to ₹1,000, or both | Yes | Non-cognizable | Any Magistrate |

BNS Section 211 FAQs

What is BNS Section 211?

BNS Section 211 addresses the legal obligation to provide notice or furnish information to public servants. Failure to comply can result in imprisonment or fines, depending on the nature of the omission.

What are the punishments under BNS Section 211?

Punishments vary based on the omission’s severity. For general omissions, imprisonment can extend to one month or a fine of ₹5,000. For omissions related to offences, imprisonment can extend to six months or a fine of ₹10,000.

Is BNS Section 211 a cognizable offence?

No, it is a non-cognizable offence, meaning the police cannot arrest the accused without a warrant.

Is BNS Section 211 bailable?

Yes, the offence is bailable, allowing the accused to secure bail and avoid custody while awaiting trial.

What happens if the omission relates to preventing a crime?

If the omission involves preventing a crime or apprehending a criminal, the punishment can be up to six months of imprisonment or a fine of ₹10,000, or both.

Can this BNS 211 offence be settled privately?

No, it is non-compoundable, meaning the case must be handled through the legal system and cannot be privately settled.

If you need support with court proceedings or any other legal matters, don’t hesitate to reach out for assistance.

Court or any other marriage-related issues, our https://marriagesolution.in/lawyer-help-1/ website may prove helpful. By completing our enquiry form and submitting it online, we can provide customized guidance to navigate through the process.

Right to Information RTI act :Your Comprehensive Guide (Part 1)

The Right to Information (RTI) Act : Explore the essence of the Right to Information (RTI) Act through this symbolic image. The image features legal documents, emphasizing the importance of transparency and accountability in governance. The scales of justice represent…

What is Article 371 of Indian Constitution ?

Article 371 of the Indian Constitution grants special provisions to specific states and regions within India, addressing their unique historical, social, and cultural circumstances. These provisions aim to accommodate diverse needs and protect cultural identities within the constitutional framework.

Indian Labour law : Your Comprehensive Guide (Part 1)

The purpose of labour laws is to safeguard employees and guarantee equitable treatment at the workplace, encompassing aspects such as remuneration, security, and perks. These regulations establish a secure ambiance by imposing minimum wage requirements, ensuring factory safety measures are…

GST :Your Comprehensive Guide (Part 1 – Understanding the Basics)

The Goods and Services Tax (GST) is like a big change in how we pay taxes in India. It started on July 1, 2017, and it’s here to simplify things. Before GST, we had many different taxes, and it could…